All about Offshore Banking

Table of ContentsWhat Does Offshore Banking Mean?The Greatest Guide To Offshore BankingTop Guidelines Of Offshore BankingA Biased View of Offshore BankingAll About Offshore BankingTop Guidelines Of Offshore BankingThe Ultimate Guide To Offshore BankingThe 45-Second Trick For Offshore BankingOur Offshore Banking PDFs

Financial institutions do this by charging even more rate of interest on the car loans as well as other debt they provide to borrowers than what they pay to individuals that utilize their cost savings automobiles.

The Definitive Guide for Offshore Banking

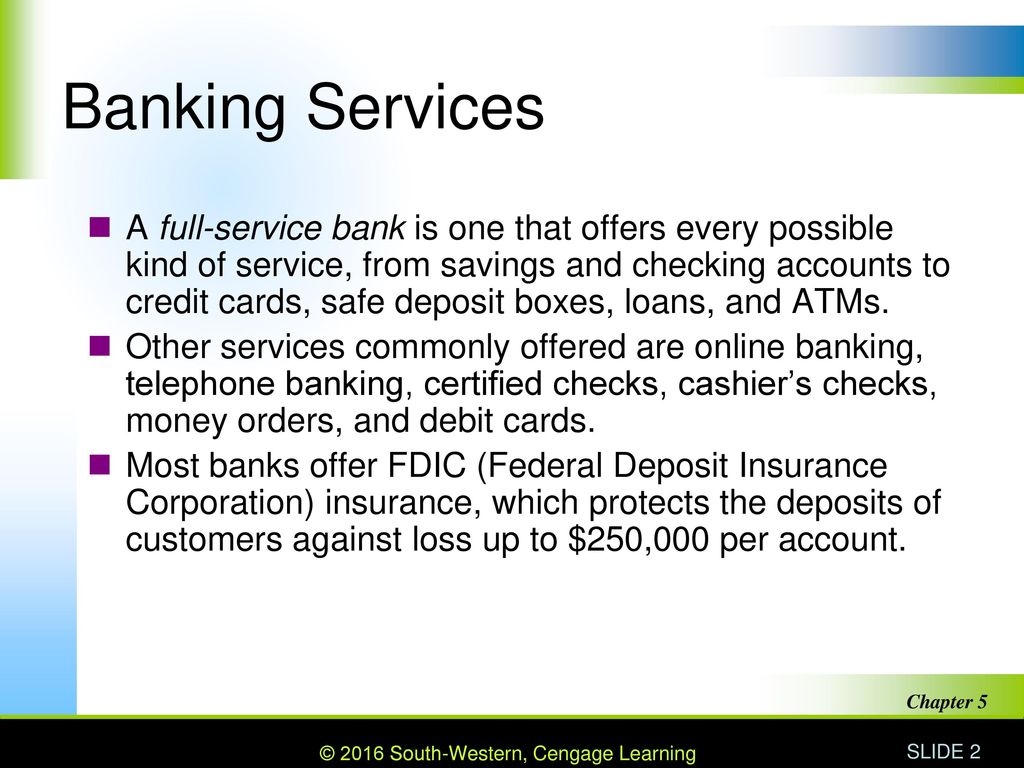

Banks earn a profit by charging even more interest to consumers than they pay on interest-bearing accounts. A bank's dimension is determined by where it is situated and also that it servesfrom little, community-based institutions to large commercial financial institutions. According to the FDIC, there were just over 4,200 FDIC-insured commercial banks in the United States as of 2021.

Ease, passion prices, and also charges are some of the variables that assist customers choose their favored financial institutions.

Some Known Incorrect Statements About Offshore Banking

This site can help you discover FDIC-insured banks as well as branches. The objective of the Securities Investor Protection Corporation (SIPC) is to recover cash and safeties in case a member broker agent firm fails. SIPC is a nonprofit firm that Congress created in 1970. SIPC protects the consumers of all signed up brokerage firms in the united state

Offshore Banking - The Facts

You ought to think about whether you wish to maintain both service as well as personal accounts at the exact same financial institution, or whether you desire them at separate financial institutions. A retail bank, which has fundamental financial solutions for customers, is the most proper for everyday financial. You can choose a conventional financial institution, which has a physical structure, or an online financial institution if you do not desire or need to physically go to a financial institution branch.

A area financial institution, as an example, takes down payments and also lends in your area, which might offer a much more individualized financial partnership. Choose a practical place if you are picking a financial institution with a brick-and-mortar location. If you have a financial emergency, you do not wish to need to travel a far away to get cash money.

Unknown Facts About Offshore Banking

Some banks also use smart device apps, which can be valuable. Some huge financial institutions are relocating to finish over-limit costs in 2022, so that can be an important consideration.

After making some minimal reductions (in the type of commission), the financial institution foots the bill's value to the owner. When the bill of exchange develops, the financial institution gets its payment from the party, which had actually approved the expense. Banks offer cheque pads to the account holders. Account-holders can site attract cheques upon the financial institution to pay money.

Things about Offshore Banking

Financial institutions assist their customers in transferring funds from one area to one more via cheques, drafts, and so on. A credit score card is a card that allows its holders to make acquisitions of items and also solutions in exchange for the charge card's provider check out here right away spending for the items or service. The cardholder debenture back the acquisition amount to the card carrier over time and also with rate of interest.

Mobile banking (additionally referred to as M-Banking) is a term utilized for executing balance checks, account deals, payments, credit rating applications, and other financial purchases via a mobile phone such as a smart phone or Personal Digital Assistant (PDA), Approving down payments from savers or account owners is the key feature of a financial institution.

Some Known Factual Statements About Offshore Banking

People choose to deposit their financial savings in a financial institution because by doing so, they earn interest. Concern financial can consist of numerous different solutions, yet some preferred ones consist of free monitoring, online bill pay, financial appointment, as well as information. Customized economic as well as banking solutions are commonly offered to a financial institution's digital, high-net-worth people (HNWIs).

Exclusive Financial institutions aim to match such people with one of the most proper alternatives. offshore banking.

Getting My Offshore Banking To Work

Not just are cash market accounts Federal Down payment Insurance coverage Corporation-insured, however they make higher rates of interest than checking accounts. Money market accounts reduce the danger of investing due to the fact that you always have access to your cash you can withdraw it any time without fine, though there may some limitations on the number of purchases you can make every month - a knockout post offshore banking.

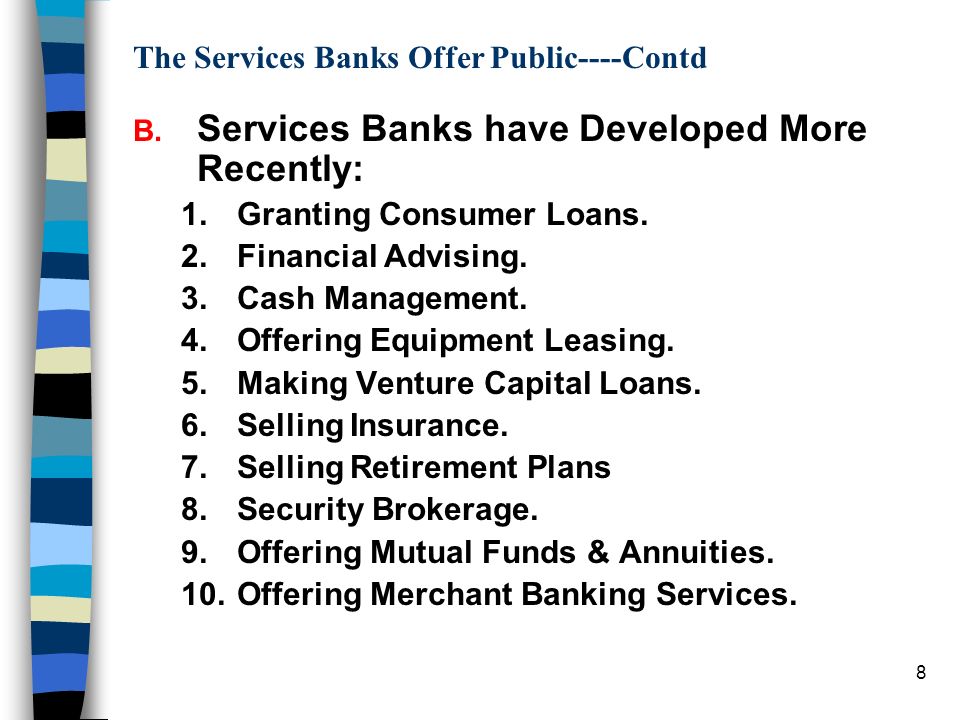

Corporate banking generally gives higher earnings for financial institutions due to the huge quantities of cash and rate of interest included with company financings. Occasionally the two divisions overlap in regards to their solutions, yet the genuine difference is in the clients as well as the revenues each banking kind earns. A service lender jobs very closely with customers to determine which banking products as well as services best fit their requirements, such as organization bank account, charge card, treasury management, car loans, also payment handling.

Some Ideas on Offshore Banking You Need To Know

You desire to choose a bank that supplies a complete array of solutions so it supports your banking needs as your service expands. ACH enables cash to be moved electronically without using paper checks, wire transfers or cash.